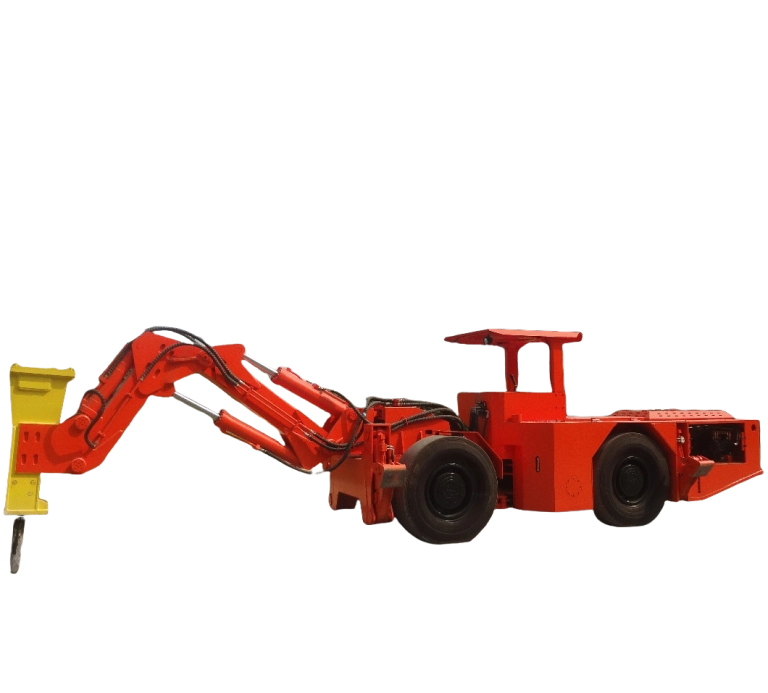

Buying an underground loader is rarely a “one-number” conversation. Two machines that look similar on paper can land in very different price bands once tunnel limits, duty cycle, safety rules, and service expectations get added to the picture. This guide breaks down the factors that influence the underground scooptram price and shows how to compare quotes in a way that matches real mine conditions, not brochure headlines.

1) Size class and productivity targets set the baseline cost

Before discussing options, most of the cost is baked in by the size class. Capacity is not only “how much it can carry,” but how the whole machine is built around that target: axle ratings, frame strength, hydraulics, cooling, and braking.

A practical way to think about it is cost per tonne moved. If a mine aims to move 1,200 tonnes per shift from a short stope with tight tramming distances, a compact loader with a smaller bucket may still deliver the lowest cost per tonne LHD loader outcome. If the haul distance is longer or the muck pile is heavy and blocky, a larger bucket and higher breakout force often pay back quickly, even if the purchase price is higher.

Many suppliers cover a wide spread of bucket volumes and payload ranges, from narrow-vein units up to higher-capacity machines for main drifts. That span alone explains why underground scooptram price discussions can vary so widely even within the same product family.

Bucket capacity vs. payload-to-weight ratio

Bucket capacity is easy to compare, but it is not the full story. A loader that fills quickly and carries a stable payload on ramps may outperform a bigger bucket that frequently spills, struggles for traction, or needs extra passes. That difference shows up as cycle time, fuel or power draw, and tyre wear, which then circles back into the true underground scooptram cost.

Tunnel envelope and turning radius

A mine that runs 3 m headings cares less about peak tonnes per hour and more about clearance, articulation geometry, and turning radius. Tight turning is a cost driver because it affects frame design, axle placement, steering components, and tyre selection. It can also force a lower profile package and revised service access, which adds engineering and manufacturing complexity.

2) Powertrain choice changes both purchase price and infrastructure cost

The “diesel vs electric” discussion is now part of almost every tender. The power source influences the initial quote and the site-side spending that comes with it.

A diesel unit can be deployed fast with minimal electrical upgrades, but it may increase ventilation demand in deep headings. An electric unit can reduce heat and emissions at the face, but it may require charging bays, cable management, or higher-capacity electrical distribution depending on the design. Those infrastructure items are not always visible in the machine quote, yet they can be decisive in the diesel vs electric LHD total cost comparison.

Diesel configuration cost drivers

In diesel configurations, the cooling pack, filtration, and heat management are often underestimated. Hot mines, high-altitude sites, and long ramps can require larger cooling capacity and stronger drivetrain components. Those changes can raise the LHD loader price even when bucket size stays the same.

Electric configuration cost drivers

For electric layouts, higher upfront cost is commonly linked to the onboard electrical system, protection hardware, and site integration requirements. Even when energy cost per hour is attractive, buyers should budget for charging workflow, spares planning, and training for electrical troubleshooting. That is why electric scooptram cost decisions should be tied to shift patterns and the mine’s electrical readiness, not only to the purchase price.

3) Safety, compliance, and operator environment add cost for good reason

Underground equipment is a safety-critical purchase. Options that look like “extras” in a quote can be mandatory depending on jurisdiction, insurance requirements, or internal mine standards.

A protected operator structure, effective braking on ramps, clear sightlines, and stable handling on uneven floors are not optional in practice. Many mines also specify enclosed cabins for dust and noise control, along with fire suppression and emergency steering provisions. These items increase the underground scooptram price, but they also reduce lost-time incidents and unplanned downtime, which is where the larger financial risk sits.

Brakes, axles, and ramp performance

Ramp grade is a hidden pricing lever. A mine with frequent 15–20% gradients will push for higher braking margins, robust axles, and traction-focused driveline choices. Those components cost more, but they directly impact reliability and tyre life on long declines.

Onboard monitoring and diagnostics

Modern mines also want simple fault finding and parameter monitoring, especially where maintenance teams cover multiple headings. A built-in monitoring system can shorten troubleshooting, reduce unnecessary part swaps, and keep availability high. That is a legitimate cost driver because it involves sensors, wiring, software, and validation work.

4) Customization and duty cycle requirements can move the quote quickly

Two mines can order “the same size loader” and still receive very different quotes due to duty cycle and customization.

A loader working in abrasive ore with frequent impacts needs stronger bucket wear protection and reinforcement. A mine that prioritizes quick bucket filling may specify higher breakout force or altered linkage geometry. Another site may focus on low profile, tighter turning, or specific maintenance access constraints. Each of these pushes design and component selection, which is why underground loader customization options often show up as meaningful line items.

5) Build quality, service access, and maintainability affect lifetime cost

Buyers often ask for a price, but operators live with the machine for years. The smarter comparison is the underground loader operating cost per hour across the planned service life.

Service access is one of the most underrated price factors. Ground-level checks, safe access to daily service points, and layouts that reduce the time spent on routine work can lift the initial quote, yet they typically pay back through higher availability and fewer maintenance-related incidents. Several underground loader designs emphasize easier daily maintenance for safer servicing, and that design intent has real manufacturing implications.

Parts strategy and downtime risk

Scooptram maintenance cost is not only about filters and fluids. A mine should ask how fast common wear parts can be supplied, whether parts can be stocked locally or through consignment, and what the lead time looks like for major components. Slow parts pipelines turn small failures into long production losses, which can dwarf any savings on the purchase order.

6) After-sales support, warranty terms, and training influence the “real” price

Quotes are not equal if the support behind them is different. Warranty scope, response time, field service capability, and training support can change total ownership cost dramatically.

Some suppliers offer structured after-sales programs with defined warranty periods (often expressed in months or engine hours), along with rapid technical support and planned inspection visits. These commitments are part of the commercial value even when they do not appear as “hardware.” Buyers comparing LHD loader warranty and service terms should treat them as cost factors, not freebies, because they reduce risk and stabilize production planning.

7) Logistics, delivery lead time, and payment terms can shift the final number

Even a well-matched machine can become expensive if logistics are ignored. Delivery lead time matters when a mine is expanding headings or replacing a failed unit. Freight route constraints, packaging requirements, and destination handling capacity all add cost.

Payment terms and risk allocation also matter. Financing structure, currency exposure, and acceptance testing requirements can change the total delivered cost. Buyers searching for scooptram delivery lead time or underground mining loader financing are usually trying to avoid schedule shocks, and those concerns belong in the evaluation stage, not after a purchase decision is made.

A supplier perspective: Yantai Chi Hong Machinery Co., Ltd.

烟台驰鸿机械设备有限公司 has focused on underground mining equipment for more than a decade, building a manufacturing system that covers design, production, and service support. The company operates a large production base with dedicated technical staff and quality management certifications, and it supplies multiple categories of underground machines, including underground scooptrams, to international customers. Its service approach emphasizes practical uptime support, including structured warranty terms, technical consultation, and spare parts planning aimed at reducing downtime risk in working mines.

结论

The underground scooptram price is shaped by far more than bucket size. Tunnel geometry, ramp grades, power source, safety requirements, diagnostics, service access, parts strategy, and support commitments all move the final quote. The most reliable way to compare offers is to anchor every decision to site facts: tonnes per shift targets, haul distances, ventilation limits, maintenance capability, and delivery timeline. When those inputs are clear, the “right” machine often becomes obvious, and the cost discussion becomes easier to defend internally.

常见问题解答

What affects underground scooptram price the most?

The biggest drivers are size class (bucket and payload), tunnel envelope constraints, and the powertrain choice. After that, safety compliance, ramp performance requirements, and support terms can significantly change the final quote.

Is a higher underground scooptram cost always a bad sign?

Not necessarily. A higher upfront number can reflect stronger driveline components for steep ramps, better service access, or added safety systems. If those features reduce downtime and improve cost per tonne LHD loader performance, the lifetime cost can be lower.

How should a mine compare LHD loader price quotes fairly?

Use the same working assumptions for each quote: haul distance, gradient, bucket fill factor, shift hours, and required safety configuration. Then compare operating cost per hour, expected availability, parts support, and warranty and service coverage, not only the purchase figure.

Why does electric scooptram cost sometimes look higher at purchase?

Electric units can involve higher-cost electrical systems and may require charging or power distribution upgrades. The payback often comes from lower energy cost, reduced heat and emissions at the face, and potentially less ventilation demand, depending on the mine.

What questions reduce surprise costs after purchase?

Ask about scooptram spare parts availability, typical lead times, planned maintenance intervals, service response options, and what is included in commissioning and training. These items often decide real uptime and budget stability once the loader is underground.